Cryptocurrency: What Is the Future of it?

Cryptocurrency has taken the financial world by storm, sparking debates about its potential to replace traditional banking systems. With digital currencies like Bitcoin, Ethereum, and countless others gaining traction, many believe that cryptocurrency is the future of finance. But is it truly the financial revolution we’ve been waiting for, or just another passing trend?

What is Cryptocurrency?

Cryptocurrency is a decentralized digital currency that operates on blockchain technology. Unlike traditional money, which is regulated by governments and financial institutions, cryptocurrencies function through a distributed ledger system. This makes transactions transparent, secure, and free from centralized control.

The Advantages of Cryptocurrency

- Decentralization and Financial Freedom

One of the most appealing aspects of cryptocurrency is its decentralized nature. Unlike traditional banking systems, where financial institutions control transactions, cryptocurrencies allow users to have full control over their funds. This eliminates the need for intermediaries like banks and lowers transaction costs.

- Faster and Cheaper Transactions

Cryptocurrency transactions are often faster and cheaper than traditional banking transfers, especially for international payments. Traditional banking systems involve intermediaries, currency exchange fees, and lengthy processing times, whereas cryptocurrencies facilitate near-instant global transactions at minimal fees.

- Enhanced Security and Transparency

Blockchain technology ensures that cryptocurrency transactions are secure and transparent. Every transaction is recorded on a public ledger, reducing the risk of fraud. Additionally, encryption and cryptographic security make it difficult for hackers to manipulate transactions.

- Inflation Resistance

Unlike fiat currencies, which are subject to inflation due to government policies and excessive printing, many cryptocurrencies have a fixed supply. For example, Bitcoin is capped at 21 million coins, making it deflationary in nature and potentially more valuable over time.

Challenges and Risks of Cryptocurrency

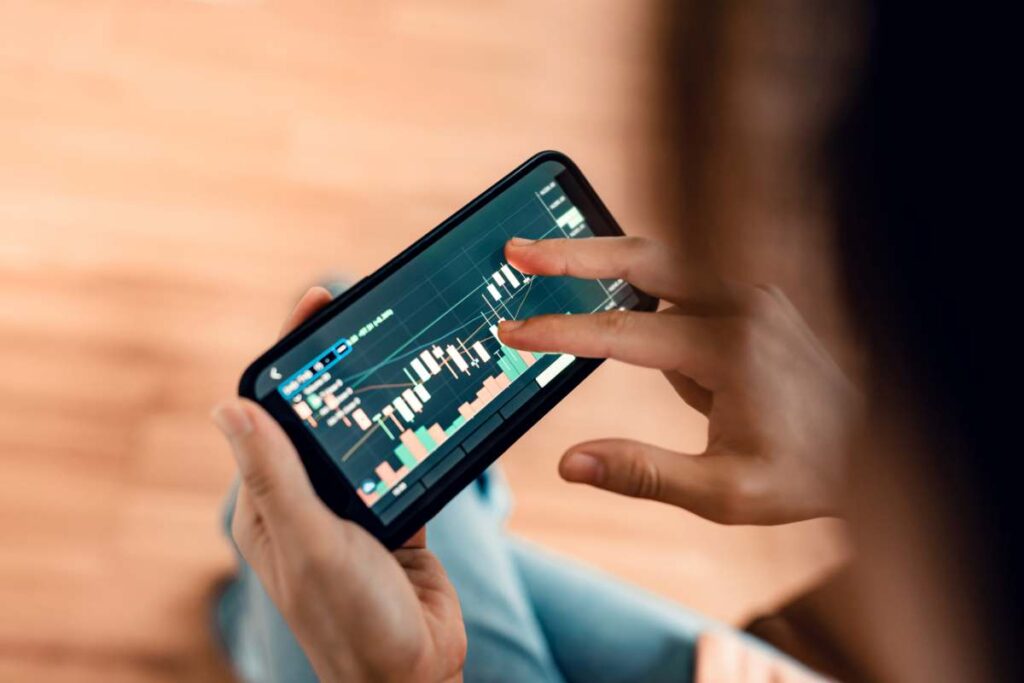

- Volatility and Market Fluctuations

Cryptocurrencies are highly volatile, with prices fluctuating dramatically in short periods. Bitcoin, for example, has experienced both rapid surges and significant crashes. This unpredictability makes it a risky investment compared to stable assets like gold or fiat currencies.

- Regulatory Uncertainty

Many governments are still figuring out how to regulate cryptocurrencies. While some countries embrace digital currencies, others have banned or restricted their use due to concerns over illegal activities, tax evasion, and financial stability.

- Security Concerns and Scams

Despite blockchain’s security features, cryptocurrency exchanges and wallets are often targeted by hackers. Scams, phishing attacks, and Ponzi schemes are common, leading to significant financial losses for unsuspecting investors.

- Limited Adoption in Daily Transactions

While more businesses are accepting cryptocurrency payments, mainstream adoption remains limited. Most people still rely on traditional banking systems for everyday transactions, making it difficult for crypto to replace fiat currencies completely.

Is Cryptocurrency the Future of Finance?

The future of cryptocurrency depends on several factors, including regulation, technological advancements, and global adoption. While it offers numerous benefits, such as decentralization, low-cost transactions, and security, its volatility and regulatory challenges hinder widespread acceptance.

Some experts believe that cryptocurrencies will complement traditional finance rather than replace it. Central banks are also exploring the concept of Central Bank Digital Currencies (CBDCs), which could bridge the gap between fiat and digital currencies.

Final Thoughts

Cryptocurrency is undoubtedly reshaping the financial landscape, but whether it becomes the dominant form of money remains uncertain. As technology evolves and regulations become clearer, crypto could play a significant role in the future of global finance. Until then, it remains an exciting yet unpredictable space for investors and financial experts alike.